Kanso is your go-to app for managing digital communications effortlessly. Designed to help you organize messages, calls, and emails from financial companies, Kanso puts you in control of your time and interactions, reducing stress and simplifying your digital life.

In today's digital age, individuals are bombarded with communication from multiple companies, especially during times of financial difficulty. This constant influx of messages via email, SMS, and phone calls intrudes into users' personal space, causing stress, anxiety, and a sense of loss of control over their time and privacy. The existing solutions for managing such communication are often fragmented and ineffective, exacerbating users' frustrations and making it challenging to prioritize and respond to important messages.

The goal of the Kanso project is to empower individuals to regain control over their digital communication, particularly during periods of financial difficulty, and alleviate the associated stress and anxiety. By providing users with a centralized platform equipped with automation and organization tools, Kanso aims to streamline communication from companies, enable users to manage interactions on their terms, and ultimately enhance their overall well-being and peace of mind. The project seeks to create a solution that not only meets users' functional needs but also resonates with their emotional desires for control, efficiency, and security in their digital interactions.

Kanso is a revolutionary mobile application designed to alleviate the stress and anxiety caused by digital communication overload, especially during financial difficulties. The application aims to empower users to regain control over their personal space by providing a centralized platform to manage communication from companies across various channels, including SMS, email, and voice. Kanso leverages automation and artificial intelligence to streamline communication, prioritize interactions, and provide users with the tools they need to manage their digital interactions on their terms.

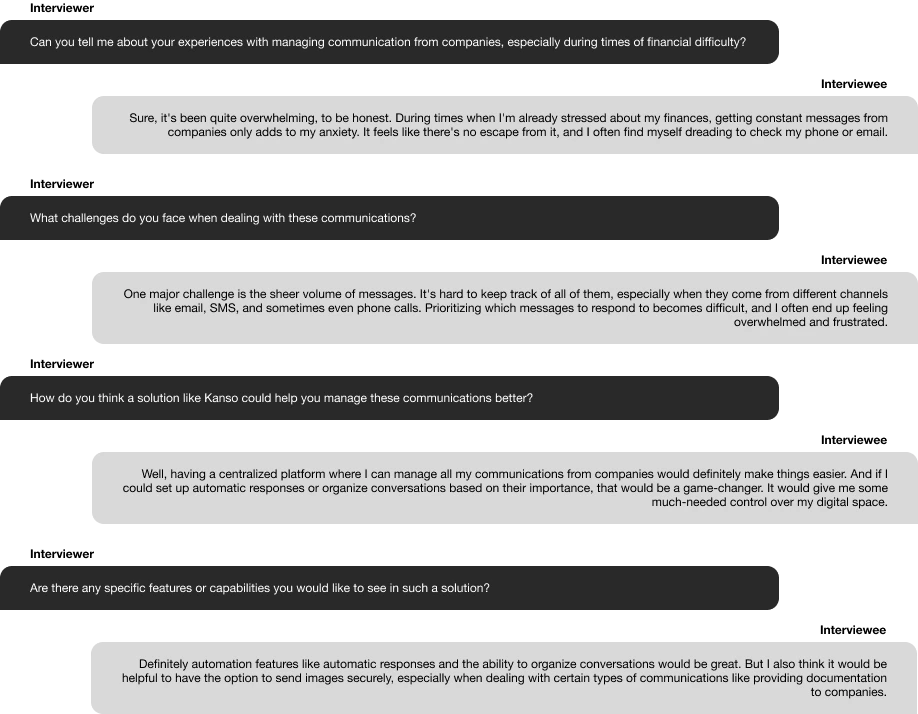

Users feel overwhelmed and stressed by the constant barrage of messages from companies, particularly during times of financial difficulty. This constant digital intrusion contributes to increased anxiety and a sense of loss of control over personal space.

Users express a strong desire to regain control over their digital communication, especially when it comes to managing interactions from companies. They seek solutions that enable them to prioritize and manage communication on their terms, reducing stress and anxiety in the process.

Users value efficiency and organization in managing communication from companies. They express a need for automation features such as automatic responses and organization tools to streamline communication, save time, and alleviate the burden of constant digital clutter.

Users feel overwhelmed and stressed by the constant barrage of messages from companies, particularly during times of financial difficulty. This constant digital intrusion contributes to increased anxiety and a sense of loss of control over personal space.

Users emphasize the importance of security and privacy when communicating with companies. They seek solutions that ensure their data and personal information remain secure, particularly when sharing sensitive information or documents electronically.

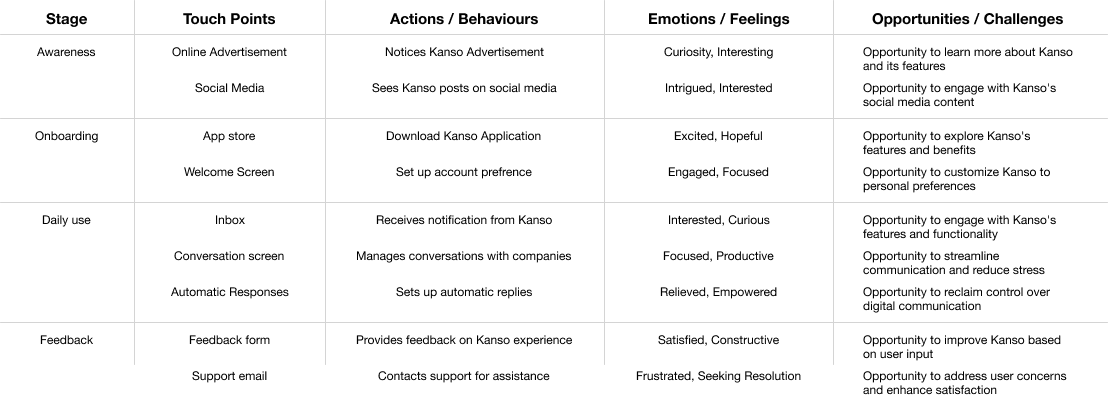

Context: During times of financial difficulty, receiving numerous messages from companies adds to my stress and anxiety.

Trigger: Every time I receive a new message from a company, I feel overwhelmed and unsure of how to prioritise and respond.

Outcome: By efficiently managing communication from companies, I regain control over my digital space, reducing stress and anxiety in the process.

Context: I often find myself unable to respond to messages from companies immediately due to other commitments or personal reasons.

Trigger: I receive messages from companies during busy periods or when I'm unavailable, I feel frustrated by the expectation of an immediate response.

Outcome: By setting up automatic responses and prioritising communication based on importance, I can manage interactions with companies more effectively, ensuring I respond to critical messages promptly while addressing less urgent ones at my convenience.

Welcome to Kanso! Simplifying your digital life starts now. Experience the benefits firsthand: manage communications effortlessly, prioritise peace of mind, and reclaim your time. Let's get started: log in or create your account.

Welcome to Kanso! Simplifying your digital life starts now. Experience the benefits firsthand: manage communications effortlessly, prioritise peace of mind, and reclaim your time. Let's get started: log in or create your account.

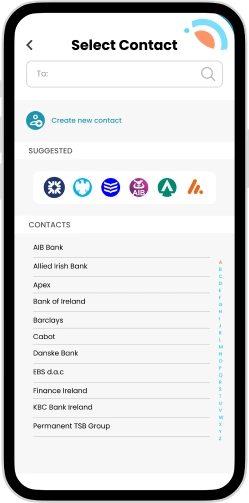

In the 'Add Your Contact' section, efficiently manage your financial contacts with ease. Simply input your contact details, undergo verification, and enjoy streamlined management. Your financial contacts, now at your fingertips, ready for efficient handling.

Easily message financial companies within the app. Schedule messages, send instantly, and manage all fintech contacts effortlessly. Deleted conversations are archived for 30 days, giving you the option to recover and restore within that timeframe.

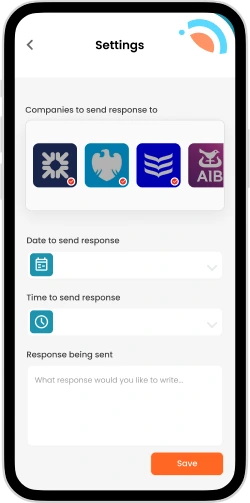

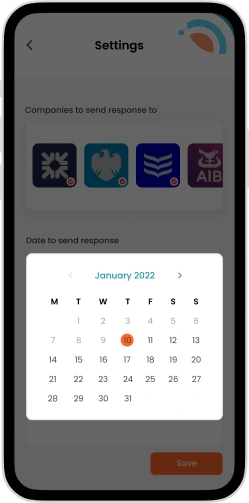

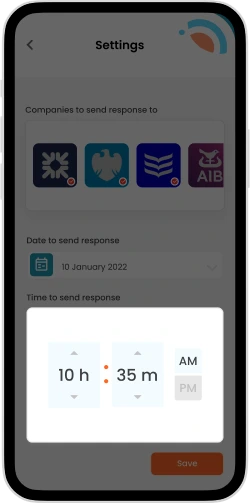

Tailor your availability note for financial companies, accommodating your busy schedule. Set preferred contact times and dates, allowing customers to schedule conversations at their convenience. Empower users to manage communication on their terms effortlessly.

Kanso revolutionizes digital communication by offering users a streamlined and user-friendly platform to manage interactions with financial companies. With features like customizable busy notes and scheduled messaging, users can reclaim control over their time and prioritize their engagements effectively.

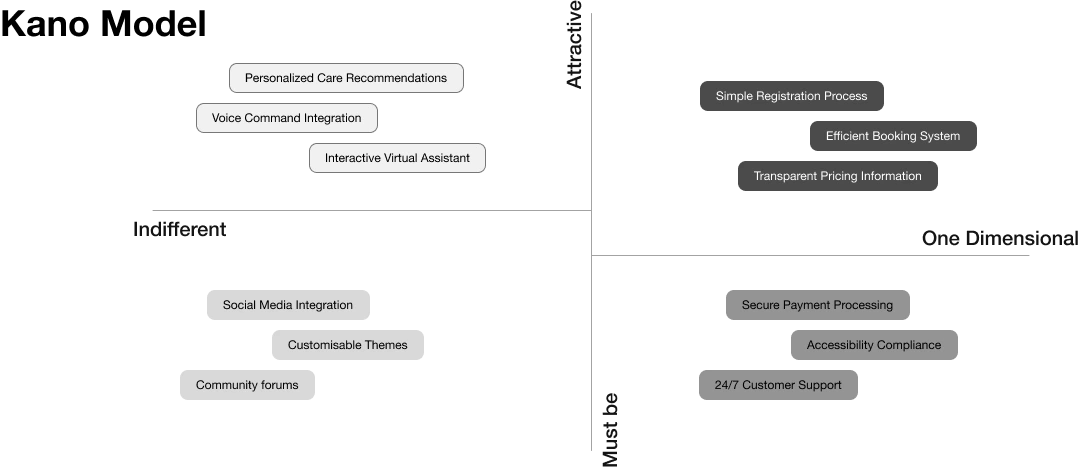

Expand Kanso's reach by integrating with additional financial services, offering users a comprehensive solution for managing all financial communications.

Further customization options, such as personalized chatbot responses and tailored notifications, can enhance the user experience.

Implement robust security measures to safeguard user data and ensure privacy in all interactions with financial companies.